Preparing Your Home for A Successful Sale

Selling your home can be a complex process, but proper preparation can make all the difference. To attract buyers and achieve the best possible price, it’s essential to get your home in top shape. Here are some key steps to prepare your home for sale.1.) Declutter and DepersonalizeStart by decluttering your home to create a clean and spacious environment. Remove personal items, such as family photos and personal collections, to allow potential buyers to envision themselves living in the space. Consider renting a storage unit for excess items to keep your home neat and organized.2.) Deep CleanA spotless home makes a strong impression. Deep clean every room, including carpets, windows, and appliances. Pay special attention to high-traffic areas like the kitchen and bathrooms. A clean home not only looks more appealing but also suggests that it has been well-maintained.3.) Make Necessary RepairsAddress any minor repairs that could deter buyers. Fix leaky faucets, patch up holes in walls, and replace broken tiles. Consider hiring a professional for more significant repairs. Taking care of these issues upfront can prevent them from becoming negotiation points later.4.) Enhance Curb AppealFirst impressions matter, so make sure the exterior of your home is inviting. Mow the lawn, trim hedges, and plant flowers to enhance your home’s curb appeal. Repaint the front door, clean the driveway, and ensure that the exterior lighting is functional and attractive.5.) Stage Your HomeStaging your home can make it more appealing to potential buyers. Arrange furniture to highlight the home’s best features and create a sense of flow. Use neutral colors and décor to appeal to a broad audience. Professional staging can be a worthwhile investment if your budget allows. ConclusionPreparing your home for sale involves several important steps, from decluttering and deep cleaning to making repairs and enhancing curb appeal. By taking the time to properly prepare your home, you can attract more buyers and potentially secure a better sale price. With a well-presented home, you’ll be well on your way to a successful sale.The post Preparing Your Home for A Successful Sale appeared first on 719 Lending.

Read More-

Imagine standing at the edge of a new beginning. Sarah, a young professional in Colorado Springs, has just found her dream home. With excitement and a bit of anxiety, she begins to explore loan options, trying to understand the various loan terms. 719 Lending can help. 1. What Are Loan Terms?Loan terms are the conditions agreed upon between the borrower and the lender for the repayment of the loan.These terms include important details such as the interest rate, loan amount, repayment period, and any additional fees or penalties. Understanding these terms is crucial because they directly impact the total cost of the mortgage and the monthly payments the borrower must make.Additionally, loan terms can affect a borrower’s financial stability and long-term financial goals. By comprehending these terms, one can make informed decisions that align with their financial strategy and ensure they are not taken by surprise by hidden costs.719 Lending offers the expertise needed to navigate through these loan terms with confidence. Engage with their knowledgeable team at www.719lending.com to gain clarity and secure a loan that suits your needs. Their commitment to transparency and customer education can make all the difference in your home-buying journey.2. Key Components of Loan TermsEvery loan term consists of several essential components that dictate the borrower’s experience and lender’s expectations.For instance, these include the interest rate (fixed or variable), the principal loan amount, the loan term length, and any associated fees or penalties. These factors are vital in determining the overall cost of the mortgage and its affordability.Terms like “prepayment” and “amortization” are also significant in evaluating the loan’s financial dynamics.2.1 Interest RatesUnderstanding interest rates—whether fixed or variable—forms the cornerstone of grasping loan terms effectively.Fixed interest rates provide predictable monthly payments, making it easier to manage your budget over time.Variable interest rates, by contrast, can fluctuate based on market conditions, thereby affecting your monthly payments dynamically. This presents both opportunities and challenges depending on economic movements.Whether aiming for stability or potential cost savings, choosing the right type of interest rate is a pivotal decision in your loan journey. 719 Lending stands ready to guide you through this critical choice with expertise and clarity.2.2 Loan DurationLoan duration refers to the length of time over which a loan is repaid.Understanding loan duration is crucial for all loan applicants. The term of the loan significantly influences the affordability of monthly payments, allowing borrowers to manage their financial commitments effectively. Generally, shorter loan durations involve higher monthly payments but lower total interest costs over the life of the loan.Borrowers must weigh their ability to commit to these terms.Longer loan durations offer the benefit of lower monthly payments—this can make it easier for individuals to afford their mortgage without sacrificing other financial goals. However, the trade-off is a higher overall interest expense over the extended term.719 Lending assists clients in navigating these choices with confidence. They offer personalized advice tailored to each borrower’s unique situation, ensuring optimal decision-making for Colorado real estate purchases. Take advantage of their expert services today by visiting www.719lending.com.2.3 Monthly PaymentsMonthly payments represent a pivotal aspect of any loan agreement. They determine how much a borrower will need to pay each month over the course of the loan.Understanding how monthly payments are calculated helps in budgeting and financial planning. It also provides insights into the true cost of borrowing.Monthly payment amounts are influenced by several factors including interest rate, loan term, and principal amount. Borrowers should carefully analyze these factors to ensure manageable payments without compromising other financial goals.719 Lending is committed to helping clients understand their monthly payments and offers tailored solutions for Colorado Springs, Colorado real estate transactions. To explore how they can assist in managing your loan terms, visit their website at www.719lending.com. Empower yourself with knowledge and make informed financial decisions.3. Different Types of LoansUnderstanding the different types of loans is essential for making informed financial decisions. Common loan types include fixed-rate mortgages, adjustable-rate mortgages, and personal loans, each offering unique terms and benefits.Fixed-rate mortgages provide stable monthly payments, while adjustable-rate mortgages offer flexibility and potential initial savings. Personal loans can be used for various purposes, making them versatile financial tools.3.1 Fixed-Rate LoansFixed-rate loans are a popular choice due to their predictability and stability. With a fixed-rate loan, the interest rate remains consistent throughout the loan term, providing peace of mind to borrowers.Predictability: Payments remain the same, making it easier to budget long-term.Stability: Immune to interest rate fluctuations, offering financial security.Simplicity: Straightforward terms simplify the understanding for borrowers.Borrowers benefit from not having to worry about changing market conditions. These loans are often preferred by those who plan to stay in their homes for a longer period.To learn more about fixed-rate loans and how they can benefit your Colorado real estate investment, visit 719 Lending.3.2 Adjustable-Rate LoansAdjustable-rate loans adapt to borrowers’ unique needs.These loans offer a variable interest rate that can change periodically. For initial terms, typically three to ten years, the interest rate is lower than fixed-rate mortgages. Consequently, borrowers can enjoy significant savings on monthly payments during the initial period. However, it’s important to be aware of potential interest rate increases in the future.Flexibility is one of these loans’ major benefits.This type of loan is ideal for those who do not plan to stay in their home long-term. Since the initial interest rates are lower, borrowers can capitalize on the savings if they sell or refinance before the rate adjusts.For an in-depth guide on how adjustable-rate loans can fit your financial goals in the Colorado Springs real estate market, explore 719 Lending and connect with our seasoned experts today. Understanding your loan terms is the first step towards smart financial planning.3.3 FHA LoansFHA loans are designed to help buyers with lower credit scores and smaller down payments.Lower down payment: Typically only 3.5% of the home’s purchase priceFlexible credit requirements: Easier for those with less-than-perfect creditAssumable mortgages: FHA loans can be transferred to a new buyerGovernment-backed: Offers protection to lenders, encouraging loans to more applicantsThese loans are often the key to homeownership for many first-time buyers.For those navigating the Colorado Springs real estate market, FHA loans provide a pathway to owning a home.Explore more details about FHA loan terms and see how they might be the perfect fit for your financial goals by visiting 719 Lending.4. How Loan Terms Affect Your MortgageLoan terms significantly shape your financial journey toward homeownership, impacting both monthly payments and overall costs.Specific terms, like interest rates and loan duration, can greatly affect your budgeting, influencing your capacity to manage monthly expenses and long-term financial stability. Shorter loan terms mean higher monthly payments but less interest over the loan’s life.Conversely, longer loan terms offer lower monthly payments, making budgeting easier but increasing the total interest paid over time. It’s essential to understand these dynamics to make informed decisions that align with your financial objectives.Moreover, knowing how loan terms influence mortgage outcomes helps in optimizing your Colorado real estate investments. For personalized guidance and expert advice, connect with the professionals at 719 Lending. They are dedicated to helping you navigate the complexities of mortgages and achieve your homeownership dreams efficiently.5. Essential Loan Terms for Colorado HomebuyersUnderstanding key loan terms is critical for Colorado homebuyers to make informed decisions.Loan-to-Value (LTV) ratio, for instance, affects your interest rates.A higher LTV ratio generally means higher interest rates and mortgage insurance costs. Knowing your LTV can help you negotiate better terms with your lender.Additionally, familiarize yourself with the term “amortization.” It refers to the gradual repayment of your loan’s principal over time, typically through monthly payments. By understanding amortization, you can estimate how long it will take to pay off your loan and how much interest you will pay overall. For detailed explanations and personalized advice, visit 719 Lending.6. Tips to Choose the Best Loan TermsSelecting the best loan terms requires careful consideration of your financial situation, future plans, and personal preferences to ensure the ideal mortgage fitting your needs.Firstly, assess your credit score as it significantly impacts the loan offers available to you.Second, understand the term length of the loan, keeping in mind that a longer term often results in lower monthly payments.Next, look at the interest rates offered, as these will determine your overall cost of borrowing (fixed versus adjustable-rate options).Another crucial step is to compare the fees and closing costs between different lenders, ensuring no hidden charges affect your financial outlook.Always seek advice from experienced professionals, like those at 719 Lending, who can provide insights tailored to Colorado Springs and Colorado real estate markets.Finally, prioritize reviewing the repayment terms to ensure they align with your financial goals. Thoughtful evaluation leads to smarter decisions and a secure financial future.7. Common Mistakes to AvoidRushing through the loan application process.Many individuals make the mistake of not fully understanding loan terms. For example, some overlook the significance of prepayment penalties, which can lead to substantial unexpected costs if they decide to pay off their loan early. Similarly, neglecting to read fine print may result in agreeing to unfavorable conditions.Ignoring the importance of shopping around.Failing to consider additional costs can lead to financial strain. This includes not only the monthly payments but also the fees and closing costs that add up over time.Being swayed solely by low interest rates – it is vital to consider the overall cost, including the length of the loan and other related expenses.Lastly, bypassing professional advice can prevent a borrower from making sound decisions. Engaging the expertise of trusted professionals at 719 Lending ensures that all aspects of Colorado Springs, Colorado real estate and finance are comprehensively understood, paving the way for a secure and prosperous future. Engaging professional advice can mean the difference between a stressful experience and a seamless journey to homeownership.8. How 719 Lending Can Help719 Lending alleviates your loan-related stress.Their seasoned professionals guide you through loan terms. They offer personalized insights into every financial aspect, assisting with Colorado Springs, Colorado real estate decisions. Moreover, they ensure you comprehend the significant financial implications of your loan, fostering a long-term partnership focused on your prosperity.Clear advice for every step.They tailor solutions to your unique needs – providing clarity amid the complex language of loans. This dedication to customer-centric service makes 719 Lending the go-to choice for Colorado home buyers.For more information, visit www.719lending.com. Their comprehensive resources and dedicated team are your gateway to a secure financial future. Embrace their expertise, and transform your homeownership dreams into reality with confidence and ease.9. Getting Started with 719 LendingGetting started with 719 Lending is simple, professional, and highly rewarding.At 719 Lending, the journey begins with a thorough understanding of your financial profile, ensuring tailored solutions to meet your specific needs. Their seasoned experts will guide you through the intricacies of loan terms, helping you make informed decisions that align perfectly with your goals. They are committed to empowering Colorado Springs residents to achieve their homeownership dreams.Prospective homebuyers can expect a streamlined process, beginning with an in-depth consultation. The team’s personalized approach ensures that every client receives expert advice, demystifying complex loan terms and enabling a confident start towards securing a dream home. Visit www.719lending.com to explore their comprehensive resources designed to support your financial aspirations.Reach out to 719 Lending today and take the first step towards a secure and prosperous future. By leveraging their deep knowledge of Colorado Springs real estate and loan terms, you can transform your homeownership dreams into a reality. Their user-friendly platform, combined with unparalleled customer service, ensures a phenomenal experience from start to finish.External ResourcesConsumer Financial Protection BureauFederal Housing AdministrationNational Association of Realtors The post Understanding Loan Terms appeared first on 719 Lending.

Read More What is APR and Why It Matters in Mortgages

What is APR?APR, or Annual Percentage Rate, is a crucial factor in understanding mortgage costs. It represents the yearly cost of borrowing, including interest and fees. By comparing APRs, you can identify the most affordable loan for your Colorado real estate needs. Explore additional resources and get personalized guidance at www.719lending.com. Definition of APR in Real EstateAPR, or Annual Percentage Rate, is a measure of the cost of borrowing money, encompassing interest and associated fees. Understanding APR is essential for making informed real estate decisions.In Colorado real estate, APR helps buyers compare different mortgage options more effectively. It reflects the true cost of a loan by accounting for various expenses related to borrowing.APR includes interest, discount points, and other mandatory loan fees.Prospective homeowners should prioritize APR when evaluating mortgage offers. By visiting 719 Lending, they can gain valuable insights and support in navigating Colorado Springs’ competitive real estate market.Importance of APR in MortgagesAPR’s importance in mortgages cannot be overstated, as it influences long-term financial decisions. Comparing different APRs allows homebuyers to identify the most cost-effective loans, ensuring they receive the best possible deal.In Colorado Springs’ dynamic real estate market, understanding APR is pivotal. A lower APR can mean significant savings over the life of a loan, making it essential for prospective homeowners to focus on this critical metric. For expert guidance on navigating mortgage options, visit 719 Lending.How APR Affects Loan CostsUnderstanding APR directly impacts loan costs.APR, or Annual Percentage Rate, encompasses more than just the interest on your mortgage. It includes fees such as discount points, closing costs, and any other mandatory expenses. By considering APR, homebuyers in Colorado Springs can make more informed decisions, avoiding surprises and ultimately reducing their overall expenses.With a lower APR, loan costs drop.Even a slight decrease in APR can result in noticeable savings, especially over a long-term mortgage. Calculating the hypothetical cost savings gives prospective homeowners clarity on the real value of their loans.At 719 Lending, they are committed to helping clients understand all facets of APR. Their expert team can guide you through the intricacies of Colorado real estate, ensuring you secure the most advantageous loan possible. For more personalized advice, explore their resources at 719 Lending.How is APR Calculated?Understanding how APR is calculated involves considering several key components, beyond just the interest rate. It incorporates various fees associated with securing the loan, such as origination fees, mortgage insurance, and closing costs. By evaluating these additional expenses, APR provides a comprehensive picture of the true cost of borrowing. 719 Lending’s expert team in Colorado Springs ensures transparency and helps clients navigate the complexities of mortgage calculations. For detailed guidance tailored to Colorado’s real estate market, visit 719 Lending.Components of APRUnderstanding the components of APR is crucial for making informed decisions about real estate loans.Interest Rate: The cost of borrowing the principal amount.Origination Fees: Charges for processing the loan application.Mortgage Insurance: Insurance required if the down payment is below a certain percentage.Closing Costs: Fees incurred at the finalization of the mortgage process.These elements work together to give a complete view of a loan’s cost.Knowing these can help buyers navigate the financial landscape confidently.APR vs. Interest RateUnderstanding the difference between APR and interest rate can significantly impact your mortgage decisions. While the interest rate is the cost of borrowing the principal amount, APR is a broader measure that includes interest and additional fees.In Colorado real estate, being well-informed about these rates can save money and avoid surprises. For tailored insights, reach out to 719 Lending.Key Differences ExplainedAPR encompasses more than just interest.While the interest rate focuses solely on the cost of borrowing the principal amount, the APR provides a more comprehensive perspective. By including additional expenses such as origination fees, mortgage insurance, and closing costs, APR gives a fuller picture of the loan’s overall cost. Therefore, it is crucial to consider both figures when evaluating mortgage options.Both rates influence mortgage payments.The APR’s inclusion of other fees shows a more accurate cost representation. Ignoring APR can lead to unexpectedly higher payments. Staying informed about APR and interest rates ensures smarter financial planning and budgeting, particularly in Colorado real estate markets.Ultimately, 719 Lending offers expertise.They provide invaluable guidance by breaking down these complexities. Visit 719 Lending to explore how they can help you navigate the world of real estate financing confidently. Their insights can turn the complexity of APR into a comprehensible factor in your financial decisions.Why APR Matters for Colorado HomebuyersUnderstanding APR is crucial for Colorado homebuyers because it affects overall loan costs. The APR incorporates all associated fees, giving a more comprehensive view of the financial commitment beyond just the interest rate.By considering APR, homebuyers in Colorado Springs can make better-informed decisions. This ensures they avoid unexpected expenses and secure a loan that fits their budget perfectly.Impact on Your Monthly PaymentsAPR greatly influences monthly payments.Reduced APR results in lower monthly costs. The APR considers not only the interest rates but also fees and other charges, making it a vital factor for calculating the total cost of your loan. Thus, by prioritizing a lower APR, you can significantly lessen your financial burden.High APR increases overall costs.A higher APR can lead to more substantial monthly payments – not only will you pay more in interest over time, but initial charges might also be higher. Ensuring a thorough understanding of APR can prevent unforeseen expenses from affecting your financial stability.By choosing 719 Lending, Colorado buyers can gain expert advice on minimizing their APR. Their team is committed to assisting you in achieving the most favorable loan terms. Visit 719 Lending today to explore the best options available in the Colorado real estate market.Understanding APR in Colorado SpringsUnderstanding APR in Colorado Springs is pivotal for making informed decisions about your mortgage. The Annual Percentage Rate (APR) encompasses interest rates, fees, and other charges, offering a comprehensive view of the true cost of your loan.A lower APR means significant savings. Colorado Springs homebuyers can benefit immensely from a reduced APR, which 719 Lending can help you achieve. Visit 719 Lending to discover competitive mortgage options and expert guidance.Local Factors Influencing APRSeveral local factors influence the APR for Colorado Springs homebuyers, impacting the final cost of their mortgage.Economic Conditions: Local employment rates and economic health can affect default risks.Housing Market Trends: Property values and market demand play significant roles.Local Taxes and Fees: Additional costs like property taxes and local government fees.Lender Competition: The number of active lenders in Colorado Springs influences rates.Understanding these factors helps buyers navigate the Colorado real estate market more effectively.Seek expert guidance from 719 Lending to secure the best possible APR and loan terms.Comparing APR Rates Among LendersComparing APR rates among lenders is crucial for prospective homebuyers. It allows them to understand the true cost of borrowing and make informed decisions.In Colorado Springs, homebuyers will find varied APRs from different lenders. By evaluating the rates, they can identify the most cost-effective loan options and save money in the long run.Remember, 719 Lending offers competitive rates and expert advice to help you secure the best deal.Tips to Get the Best APRSecuring the best APR can save you thousands over the life of a loan.Improve Your Credit Score: A higher score often qualifies you for lower rates.Shop Around: Compare offers from multiple lenders to find the best terms.Consider Loan Types: Fixed rates vs. adjustable rates may affect your APR.Make a Larger Down Payment: This can reduce your APR and overall borrowing costs.Do your research to understand each factor and how it impacts your loan.Engage with professionals at 719 Lending for personalized advice tailored to your needs.Fixed vs. Variable APRWhen considering mortgage options, a borrower must evaluate the differences between fixed and variable APRs. Fixed APR offers a constant interest rate throughout the loan period, ensuring stability in monthly payments without any surprises.In contrast, variable APRs fluctuate based on market conditions. These may start with a lower initial rate, but could increase over time, potentially raising monthly payments. Engaging with 719 Lending can help Colorado Springs homeowners decide which APR type aligns best with their financial goals.Pros and Cons for EachEvaluating fixed and variable APRs reveals distinct advantages and disadvantages for each option. Buyers must consider their personal financial situations and future market conditions.Fixed APRs offer stability and predictability, with unchanging monthly payments. This benefits those who prefer a consistent budget.However, fixed APRs typically come with a slightly higher initial interest rate. Homeowners miss out on potential decreases in market rates.Variable APRs may start lower, reducing early monthly payments. This can be advantageous if market rates are expected to remain stable or decline.Yet, variable APRs hold the risk of increasing payments if interest rates rise. Borrowers must be comfortable with potential fluctuations.Choosing between the two depends on one’s tolerance for risk and financial planning preferences. 719 Lending is available to guide homebuyers in making informed decisions.By understanding the pros and cons of each, individuals can confidently navigate Colorado’s real estate market. Contact 719 Lending at www.719lending.com today to explore your options.Hidden Fees and APRUnderstanding what is APR involves knowing what it includes beyond the interest rate, such as hidden fees. These hidden fees can drastically affect overall loan costs, making it crucial for borrowers to be aware.They include origination fees, closing costs, and other charges. Knowing these helps borrowers accurately compare loan offers and avoid unexpected expenses. Visit www.719lending.com for expert guidance on navigating these nuances.What to Watch Out ForHidden fees can add up.When considering a loan, borrowers should be aware of various hidden charges. These fees, often bundled within the APR, can significantly inflate the cost of a mortgage if left unchecked. Therefore, it’s essential to scrutinize loan documents for any unexplained costs or large fees appearing within the details.Prepayment penalties can be costly.APR isn’t just about interest rates. Transaction fees, underwriting costs, and other expenses can also play a role in your total financial obligation.Always seek a trusted advisor – like the professionals at 719 Lending – to help navigate these complexities. By doing so, borrowers can ensure they are not blindsided by unexpected costs down the road.Stay informed and vigilant with 719 Lending by your side. Empower your financial future with knowledge to achieve your Colorado real estate dreams! Visit www.719lending.com for more information.APR for Different Loan TypesAPR can vary depending on the loan type, such as fixed-rate mortgages, adjustable-rate mortgages (ARMs), or government-backed loans. With each loan type, APR encompasses aspects like interest rates, lender fees, and other financing costs, making it crucial to comprehend the overall financial commitment.Understanding APR for different loan types ensures better-informed decisions and financial stability through the journey of homeownership in Colorado Springs.APR in Conventional LoansAPR, or Annual Percentage Rate, is essential in understanding the total cost of a conventional loan.Interest Rate: The base cost of borrowingLender Fees: Charges from the mortgage lenderUnderwriting Costs: Fees for processing the loan applicationOther Expenses: Includes all additional costs associated with obtaining the loanKnowing how APR is calculated helps borrowers compare different loan offers.Careful evaluation of APR aids in making informed decisions about Colorado real estate investments.APR in FHA LoansUnderstanding APR in FHA loans helps borrowers gauge the true cost of their mortgage.Interest Rate: This is the foundational cost of borrowing.Mortgage Insurance Premium (MIP): Required for FHA loans.Lender Fees: Standard charges from the mortgage lender.Third-party Fees: Costs such as appraisals and inspections.These factors collectively give a clear picture of an FHA loan’s total cost.Evaluating APR ensures informed decisions for Colorado Springs homebuyers.Visit 719 Lending to explore personalized FHA loan options.719 Lending: Your APR Experts in ColoradoWith a deep understanding of Colorado real estate, 719 Lending stands out as the go-to experts for deciphering APR. Their extensive knowledge and customer-first approach ensure clients are well-supported in making informed financial decisions.By visiting www.719lending.com, buyers can explore tailored mortgage solutions and comprehensive APR guidance.How We Help You Understand APRAt 719 Lending, they pride themselves on breaking down complex financial terms into clear, manageable pieces that everyone can grasp.Their experts, with extensive experience in Colorado real estate and finance, work diligently to provide clear explanations, guiding you through the intricacies of APR. They make sure you understand how the Annual Percentage Rate impacts your mortgage and overall cost. This way, you won’t be caught off guard by unexpected expenses.Understanding APR is crucial for making wise financial choices in the Colorado Springs real estate market. With their personalized guidance, you gain insights that empower you to confidently navigate your home-buying journey, knowing exactly what each percentage point means for your budget.Furthermore, they offer valuable resources and tools on their website, www.719lending.com, making it easier for you to explore and compare different mortgage options. Their supportive team is committed to helping you achieve your dream of homeownership with clarity and confidence. Don’t hesitate—reach out today and let them illuminate your path to real estate success!Calculating Your APR with 719 LendingUnderstanding what is APR helps in comprehensively evaluating mortgage offers. At 719 Lending, they ensure you grasp every detail, simplifying the complex calculations and clarifying how each component of APR affects your Colorado real estate finances.Their expert team tailors solutions to your specific needs, providing transparency and detailed explanations. Visit www.719lending.com to calculate your APR confidently.Using Online Tools for PrecisionImagine the possibilities with precision tools.At 719 Lending, they know that accuracy matters. Their website, www.719lending.com, offers a suite of online calculators and resources to help you estimate your APR with confidence. Additionally, tools such as mortgage calculators allow you to compare various scenarios and their potential impacts.The benefits of using these tools are clear.Navigating the complex world of Colorado real estate becomes easier when you use these precision instruments. They simplify calculations, ensuring that potential homeowners make well-informed decisions.Stay ahead of the game by leveraging advanced online tools. These resources, available 24/7, empower you to stay on top of market trends and accurate financial assessments. Visit www.719lending.com to explore all the tools and take your first step towards achieving your real estate goals.Common APR MistakesMisunderstanding, miscalculating, or underestimating APR-related costs can impact one’s finances significantly.For instance, many overlook the additional fees encompassed within the Annual Percentage Rate (APR), leading to unexpected expenses. This error can disrupt their financial planning, especially concerning interest and loan terms.Ensure distinctions between “interest rate” and “annual percentage rate” are understood to avoid costly surprises.Avoiding Costly ErrorsNavigating the world of Colorado real estate requires careful consideration of every financial detail, including APR. Missteps here can lead to significant financial setbacks. Let’s discuss how to protect yourself.First, always understand what APR encompasses. Misunderstanding can lead to costly errors.APR includes more than just interest; it reflects the true cost of borrowing. Knowing this can prevent shock expenses.Additionally, compare APRs across lenders, not just interest rates. This ensures the most accurate picture of costs.Regularly review loan documents with a trusted advisor. They can help clarify any ambiguous terms and prevent misunderstandings that could cost you later.Lastly, keep an open line of communication with 719 Lending. Their expert team can provide invaluable guidance, ensuring every APR-related decision supports your financial goals.Remember, thorough knowledge and vigilant planning are your safeguards against costly errors. Collaborate with 719 Lending via www.719lending.com for expert assistance.Tips to Lower Your APRTo lower your APR, start by improving your credit score, which can dramatically impact your loan terms. Paying bills on time, reducing debt, and avoiding new credit inquiries can bolster your credit profile, leading to a more favorable APR from lenders like 719 Lending.Effective Strategies for HomebuyersPurchasing a home can be exhilarating, but it’s essential to approach it with effective strategies. How can homebuyers ensure they secure the best possible outcome in the Colorado Springs real estate market?Since 2016, 719 Lending, a Colorado-based mortgage advisory, has successfully helped countless homebuyers decode the complexities of real estate. They offer tailored solutions that align perfectly with clients’ financial aspirations.First, it’s crucial for buyers to understand their budget. By knowing exactly how much they can afford, they avoid the risk of overextending their finances and facing potential issues down the road.Securing pre-approval for a mortgage should be the next step. This not only strengthens their purchasing power but also demonstrates to sellers that the buyer is serious and financially capable, significantly increasing their chances of securing their dream home.For personalized assistance, homebuyers can leverage the expertise of 719 Lending. Visit www.719lending.com today for guidance tailored to the unique Colorado real estate market.Questions to Ask Your Lender About APRWhen discussing APR with your lender, a myriad of important questions arise. Clarify how the APR is calculated, what fees are included, and how it compares to the interest rate. Understanding these aspects will empower you to make informed decisions and align your mortgage with your financial goals. For more expert guidance, reach out to 719 Lending at www.719lending.com.Ensuring Transparency and UnderstandingAt 719 Lending, they prioritize transparency to empower clients to make informed choices about their mortgages in Colorado.Since 2016, 719 Lending’s mission has been to demystify financial terms and systems. They engage homebuyers in Colorado Springs with clear explanations and thorough guidance, making the path to homeownership smoother.Their approach includes detailed discussions about APR, ensuring clients comprehend its influence on their mortgage and overall financial health. This proactive education safeguards clients from surprises down the line.Every consultation at 719 Lending is an opportunity to ask questions, clarify doubts, and build confidence in one’s financial decisions. This transparency fosters trust and long-term relationships.Visit www.719lending.com today and experience mortgage assistance that prioritizes your understanding and success.Call to ActionReady to take the next step towards owning your dream home in Colorado Springs? At 719 Lending, their expert team is dedicated to guiding you through every aspect of the mortgage process.Visit www.719lending.com to start your journey, schedule a consultation, and get answers to all your questions today.Get Expert APR Advice from 719 LendingFor those navigating the Colorado real estate market, understanding APR is crucial.At 719 Lending, their seasoned experts offer comprehensive guidance tailored to your needs.They simplify complex financial concepts, ensuring you gain a clear understanding of APR and how it impacts your mortgage. This empowers you to make informed decisions, fostering financial confidence and success.Reach out to 719 Lending at www.719lending.com to benefit from their expertise. With their personalized approach, you’ll find the support necessary to achieve your homeownership dreams in Colorado Springs. Join countless satisfied clients who’ve thrived with 719 Lending’s professional and dedicated service.Additional ResourcesHomebuyer 101: What is APR?Consumer Finance: What is APR?Investopedia: Difference Between Interest Rate and APR The post What is APR and Why It Matters in Mortgages appeared first on 719 Lending.

Read MoreGetting Clear on The Home Inspection Process

A home inspection is a vital step in the home buying process, providing an in-depth look at the property’s condition. Understanding this process can help you make informed decisions and protect your investment. Here’s what you need to know about home inspections.What is a Home Inspection?A home inspection is a thorough examination of a property’s physical structure and systems, conducted by a professional inspector. The inspector will assess the condition of key components, including the roof, foundation, electrical systems, plumbing, HVAC, and more. The goal is to identify any existing or potential issues that may need attention.Why is it Important?A home inspection helps you understand the true condition of the property you’re considering buying. It can reveal hidden problems that might not be apparent during a casual viewing. Knowing about these issues upfront can prevent unpleasant surprises and costly repairs down the line.The Inspection ProcessDuring the inspection, the inspector will methodically examine various aspects of the home. This typically includes checking the structural integrity, safety features, and functionality of major systems. The inspection usually takes a few hours, and it’s beneficial for buyers to attend so they can ask questions and gain a better understanding of the property’s condition. The Inspection ReportAfter the inspection, the inspector will provide a detailed report outlining their findings. This report will highlight any defects, safety concerns, or necessary repairs. It’s a valuable tool for negotiating with the seller, as you can request repairs or adjustments to the sale price based on the inspection results. Making an Informed DecisionArmed with the inspection report, you can make a more informed decision about whether to proceed with the purchase. If significant issues are discovered, you may choose to negotiate repairs, seek a price reduction, or even walk away from the deal. ConclusionUnderstanding the home inspection process is crucial for any homebuyer. It provides a clear picture of the property’s condition and helps protect your investment. By knowing what to expect during an inspection and how to use the findings, you can confidently navigate this essential step in the home buying journey.The post Getting Clear on The Home Inspection Process appeared first on 719 Lending.

Read MoreUnderstanding the 4% Seller Concessions on VA Loans

Many homebuyers find it challenging to cover all the upfront costs, including closing costs, of purchasing a property in Colorado Springs. Imagine climbing a mountain without the necessary gear—daunting and nearly impossible for most.Help is available for understanding closing costs, charges, and other financial aspects of buying a home.Understanding the 4% seller concessions on VA loans, including closing costs, can provide the assistance needed to make homeownership attainable.1. What Are Seller Concessions?Seller concessions are financial incentives offered by the seller to attract buyers. These concessions can cover various fees associated with buying a home, but typically not the buyer’s closing costs or loan points. There’s also a limit – the concession amount cannot be more than 4% of the loan amount.In essence, these concessions are costs that the seller agrees to cover to make the transaction more appealing and manageable for the buyer. They go beyond what is customarily expected.These incentives can include paying the buyer’s VA funding fee, property taxes, hazard insurance, and other charges that the buyer might otherwise be responsible for.The goal of seller concessions is to reduce the buyer’s out-of-pocket expenses, thereby making the purchase more accessible and financially feasible.By understanding seller concessions, buyers can better navigate the home-buying process and secure favorable terms.Examples of Seller Concessions:Origination fees: The cost to process your loan application.Appraisal fees: This covers the assessment of the home’s value to ensure it meets lending requirements.Prepaid property taxes: The seller might cover property taxes for a certain period.Important Note:Seller concessions do not include typical closing costs or points. These remain the buyer’s responsibility.Title insurance is mandatory for lenders and typically not considered a concession.Attorney fees, required in some states, can be covered by seller concessions depending on the negotiation.2. How Do Seller Concessions Work?Seller concessions encompass various contributions, a means of extending financial flexibility, where sellers assist buyers. These can range from paying for the buyer’s VA funding fee to covering costs such as property taxes or insurance, which aren’t typically expected from sellers.For optimal buyer benefits in a VA loan scenario, understanding what constitutes as “concessions” is pivotal. They are not merely limited to handling loan-related closing costs. For instance, consider the prepayment of certain home expenses or even the payment of an existing loan to help the buyer qualify more solidly for their new home.In a real estate transaction, seller concessions are basically extras offered by the builder or seller that benefit the buyer without any additional cost. These are things the seller wouldn’t normally be expected to pay for.Here are some common examples of seller concessions, including closing costs:VA funding fee: The seller covers the fee associated with a VA loan.Prepaid expenses: The seller pays for property taxes and insurance upfront.Gifts: The buyer receives appliances like a TV or microwave.Interest rate buydowns: The seller pays extra points to lower the buyer’s interest rate permanently (permanent buydown) or temporarily with escrowed funds (temporary buydown).Debt payoff: The seller helps the buyer by paying off outstanding debts.What isn’t a seller concession?Normal closing costs and points that are typical for the current market interest rate aren’t considered concessions. For example, if the market rate is 7.5% with two discount points, the seller paying those two points wouldn’t be a concession. However, if they pay five points, the extra three points would be considered a concession.Example: If the market dictates an interest rate of 7½ percent with twodiscount points, the seller’s payment of the two points would not be a sellerconcession. If the seller paid five points, three of these points would beconsidered a seller concession.Why are seller concessions a concern?In some areas, builders and sellers use concessions to attract buyers. While this can be helpful, there’s a potential downside. In extreme cases, overly generous concessions might entice veterans who aren’t financially qualified for the mortgage into taking on a loan they can’t afford. The concessions can mask the real issue, which is the veteran’s inability to qualify for the loan in the first place.2.1 Definition and ExamplesSeller concessions are financial contributions, often provided by home sellers, designed to reduce buyers’ costs. These concessions can include various fees and payments, making homeownership more accessible.In the realm of VA loans, seller concessions can cover beyond-standard costs, such as prepaid property taxes, insurance, closing costs, or even other charges like appliances. This helps alleviate the buyer’s financial burden.Seller concessions in VA loans can amount up to 4% of the loan value.Understanding these concessions: If a seller covers $5,000 in loan-related fees and pays down a $3,000 car loan for a buyer, these payments contribute directly towards reducing the buyer’s upfront expenses. Those savings can significantly aid in financial planning and eligibility during the home-buying process.2.2 Common Seller ConcessionsTypical seller concessions offer substantial benefits, aiding VA loan borrowers in managing initial homeownership expenses.In practice, seller concessions often cover origination fees, which encompass the costs of underwriting and processing loans. These savings mitigate immediate financial pressure on the buyer.Sellers may also prepay property taxes, hazard insurance, and homeowners insurance, increasing the buyer’s financial ease by reducing upfront costs. The advantages resonate with those looking to ease into homeownership smoothly.Another common concession involves covering appraisal fees. VA appraisals are mandatory but can be expensive. This reduces the burden on the homebuyer further.Also included are title insurance and attorneys’ fees, essential for ensuring legal and financial safeguards during the home buying process.3. Understanding the 4% RuleThe 4% rule is a significant aspect of VA loan seller concessions. But what exactly does it mean?In essence, this guideline allows seller concessions to reach up to four percent of the established reasonable value of the property. These concessions can cover various costs without exceeding this threshold.Notably, the four-percent limit pertains exclusively to concessions and does not include standard closing costs such as discount points. This distinction provides additional financial benefits to the veteran buyer.Consider the tangible relief this rule offers. For a property valued at $300,000, seller concessions can equate to $12,000. This considerable sum can cover numerous non-recurring closing expenses.Grasping the 4% rule empowers buyers to negotiate effectively. They can leverage these concessions to lessen their financial burden significantly.Feel inspired by the financial opportunities offered by the 4% seller concessions on VA loans? Consult 719 Lending at www.719lending.com and discover how you can maximize your VA loan benefits today!4. Benefits of Seller ConcessionsSeller concessions provide a valuable opportunity for VA loan borrowers to manage upfront expenses, which can often be overwhelming, especially when buying a home in Colorado Springs.These concessions can significantly lower out-of-pocket costs for veterans.Moreover, by utilizing seller concessions, veterans can allocate more of their finances toward home upgrades or other personal expenses, enhancing their buying power and overall financial flexibility.In addition, having seller concessions can make negotiating a home purchase more favorable, as they help mitigate the immediate financial stress of the transaction, making the process smoother and more accessible. For more details, explore how 719 Lending can assist you at www.719lending.com.5. Negotiating Seller ConcessionsNegotiating seller concessions, including closing costs and other charges, requires a strategic approach to ensure the maximum benefit for the buyer, particularly in the competitive Colorado Springs market.Begin by discussing your needs with a knowledgeable VA-savvy real estate agent.Your agent will be instrumental in formulating a negotiation strategy that highlights your needs and leverages the seller’s willingness to sell as a compelling factor.With the guidance of 719 Lending, navigating the intricacies of seller concessions becomes a streamlined process, ensuring you’re equipped to secure the best possible terms for your VA loan. Visit www.719lending.com for expert advice and support in mastering your negotiation tactics.6. Role of 719 Lending in Helping You Navigate VA LoansWorking with 719 Lending can significantly enhance your home buying experience in Colorado.Their expertise simplifies the often complex process of obtaining VA loans.The team at 719 Lending is dedicated to guiding clients through every step of the VA loan process with confidence, ensuring they understand each aspect involved. They take pride in helping veterans and their families achieve their dream of homeownership.With their local knowledge, professional approach, and commitment to client success, 719 Lending stands out as a trusted partner. To learn more about how they can assist you with your VA loan journey, visit www.719lending.com and start your path towards homeownership today.7. Conclusion and Next StepsNavigating the 4% seller concessions VA loan can seem daunting at first.However, with the right guidance and knowledge, it becomes an instrumental tool for maximizing benefits.By understanding these concessions, potential homebuyers can make informed decisions that save money and ease the home-buying process.Partnering with 719 Lending, with their extensive expertise and local insights, is a strategic move towards ensuring a successful transaction.Start your journey today by visiting www.719lending.com, and let their dedicated team empower your homeownership dreams. The post Understanding the 4% Seller Concessions on VA Loans appeared first on 719 Lending.

Read MoreREcolorado Sale to Private Equity Firm: Colorado Realtor

When the news of REcolorado’s sale to a private equity firm broke, it felt like an unexpected storm hitting a serene beach. The tranquil calm was suddenly pierced with uncertainty.This is what happened with REcolorado.On June 25, 2024, the news astounded the real estate community, including the local realtor association, leaving many in disbelief.REcolorado MLS Surprises with Private Equity SaleA wave of shock hit the board.The REcolorado community received the news of its sale to a private equity firm with mouths agape. This monumental move, made without prior notice to REcolorado’s management or board, left key figures like President Gene Millman and COO Leesa Baker blindsided.Legal action might follow.The abrupt transaction without management’s involvement raises questions. The board members are now contemplating potential legal avenues to address the surprising development.For those in Colorado real estate, this could shift the landscape. At 719 Lending, they stand ready to help Colorado Springs professionals navigate any looming changes confidently. For more information, visit 719 Lending’s website.Background on Ongoing NegotiationsSince January, REcolorado’s stakeholders negotiated a buyback in good faith to recover significant shares.Both President and CEO Gene Millman and COO Leesa Baker were enthusiastic about this potential shift, having seen it as a strategic maneuver to strengthen the organization’s autonomy.Their expressions of eagerness turned to dismay upon the sale revelation, catching the local realtor association off guard as well.Recent Meetings with Realtor AssociationsRecent discussions between REcolorado and the Realtor association were intended to resolve ongoing tensions and explore potential buybacks. Management believed open communication would drive positive results and unity.However, negotiations stalled when stakeholders unexpectedly ceased communication. The board was left questioning the abrupt halt and considering strategies to regain control and cohesion.Surprising twists in discussions indicate pivotal changes in Colorado real estate governance.Board members continue to seek clarity and pursue legal options to rectify the situation. They remain committed to upholding the interests of the REcolorado community. Despite the uncertainty, they are determined to ensure stability and resilience.Offers and CounteroffersThe path to a shareholder buyback began with optimism and opportunity. Key negotiators within REcolorado took swift action.In January, the board was approached with an offer to buy out the shareholders. This offer seemed a promising step toward greater control over their future.The REcolorado team, including Vice Chair Shelly Vincent and Board Chair Mark Trenka, crafted a counteroffer. They were hopeful this counteroffer would lead to a successful agreement, bringing stability to the MLS.Despite the thorough negotiations, communication from the shareholders suddenly halted. This unexpected silence left the board puzzled and concerned about the integrity of the deal, prompting further action.Now, they face new challenges and the prospect of legal recourse. Yet, their resolve to protect REcolorado remains unwavering.Immediate Reactions from the BoardUpon learning of the sale, board members expressed shock, noting their limited involvement prior and during the transaction.The surprise, to say the least, stemmed from a growing sense of betrayal as the board and management, including President Gene Millman and COO Leesa Baker, were left in the dark. They had approached their negotiations with the shareholders in good faith, aiming to secure REcolorado’s future and better serve its vast member base.Striving to maintain their composure, they immediately called for an emergency meeting to discuss the implications. They felt the need to gather comprehensive information quickly, as uncertainty surrounding the MLS’s future grew more tangible and urgent.Despite their dismay, the board’s confidence in their legal stance offers hope. They remain committed to safeguarding REcolorado, exploring every available option to ensure transparency, stability, and continued excellence in service for Colorado realtors. This steadfast commitment strengthens their resolve, inspiring the REcolorado community to stay united and optimistic amid these turbulent times.Statements from REcolorado ExecutivesPresident Gene Millman emphasized their dedication to maintaining transparency and excellence for their members. He asserted their resolve in facing this unexpected development, striving to preserve the integrity and mission of REcolorado.COO Leesa Baker expressed determination to keep the community informed, stating, “We are committed to our members and will navigate this situation with their best interest in mind.” Both executives remain united in their efforts to protect REcolorado’s values and legacy, reinforcing their unwavering dedication to Colorado realtors.Gene Millman’s ResponseGene Millman, President and CEO of REcolorado, conveyed his surprise and concern over the unexpected sale.Commitment to Transparency: Millman emphasized their dedication to maintaining clear communication with members.Integrity of Service: He reaffirmed his unwavering resolve to preserve the mission of REcolorado.Legal and Strategic Actions: The management aims to explore every legal avenue possible to challenge the sale.Maintaining Stability: Millman assured members of their continuing efforts to ensure REcolorado remains operational and effective.In his response, he placed a strong emphasis on unity and community within REcolorado.Millman closed by encouraging Colorado realtors to stay optimistic, trusting the board’s dedication and strategic actions.Leesa Baker’s CommentsLeesa Baker, Chief Operating Officer of REcolorado, echoed the sentiments shared by Millman. She expressed her dismay at the lack of transparency throughout the process.Baker highlighted their proactive steps to represent the interests of the MLS.She emphasized the dedication of REcolorado’s leadership team to uphold the organization’s values and mission. Clear, open communication remains their top priority moving forward.In a reassuring note, Baker expressed confidence in the board’s ability to navigate these turbulent times. She reiterated her commitment to the 25,000 members, ensuring them that REcolorado will strive to provide the best possible service despite the current challenges.Details of the Private Equity FirmThe private equity firm involved in the acquisition remains unidentified as of now. Although their identity is undisclosed, speculation about their motives abounds.Their formation in January coincides suspiciously with the initial negotiations. This raises questions about their intentions with REcolorado’s future.The firm’s redacted letter of intent adds to the mystery, suggesting undisclosed terms. The REcolorado community eagerly awaits more information, hoping for a transparent resolution that prioritizes the members’ interests.As speculation mounts, Millman and Baker remain steadfast in ensuring transparency and strategizing for the best outcomes. Our readers are encouraged to visit 719 Lending for updates and insights on Colorado’s dynamic real estate landscape. Stay informed, stay empowered.Legal Considerations and Possible ActionsThey are exploring all options.Firstly, REcolorado’s legal team is working around the clock to understand their position. This includes assessing whether the shareholders’ actions were within legal bounds, especially since negotiations appeared to be in good faith. Nonetheless, potential breaches of contractual obligations will be meticulously examined.Next steps may involve court intervention.Should this route be necessary, REcolorado may seek an injunction. This would halt the progress of the sale process, providing time to explore alternative solutions.Additionally, reviewing the company’s bylaws and previous agreements will be crucial. In light of their amendments in 2023, these documents will offer significant insight. They will reveal potential strategies and avenues for challenging the shareholders’ abrupt decision.Impact on REcolorado’s MembersThis unexpected sale announcement has generated a wave of uncertainty among REcolorado’s members, particularly Colorado-based realtors who rely heavily on the MLS platform for their daily operations. Immediate concerns revolve around service continuity, data access, and potential membership changes. As 25,000 real estate professionals navigate this transition, 719 Lending remains committed to offering financial solutions tailored to their needs, ensuring they can weather this storm with confidence. For trusted advice and resources, visit www.719lending.com to stay ahead in Colorado’s competitive real estate market.Concerns of 2,500 AgentsAgents face mounting uncertainty.The sudden sale of REcolorado to a private equity firm has left agents uneasy. They rely on the MLS for critical components of their business operations, with access to listings, market data, and client management tools being essential. Now, they are forced to consider alternative platforms or risk potential disruptions.Maintaining stability is paramount.The looming question of whether REcolorado can sustain its MLS status grips agents with anxiety. Their livelihoods depend on the seamless flow of information and the integrity of the MLS platform. Any shift in this dynamic could have far-reaching consequences for their businesses.Agents must prepare for change.Given the recent developments, agents should stay informed and consider contingency plans. Engaging with industry updates, exploring new tools, and seeking financial advice can help them navigate these turbulent times. 719 Lending is here to support them through this transitional period.Visit www.719lending.com for resources and guidance to ensure your business thrives despite the uncertainties. Align yourself with a reliable partner who understands Colorado’s real estate landscape intricately. Together, we can face these challenges head-on and emerge stronger.Possible Changes to MLS OperationsAgents fear operational disruptions.Despite the surprising news, the board remains committed. They will strive to minimize disruptions and ensure continuous functionality, reflecting their deep commitment to the membership’s best interests. However, given the opaque nature of the recent deal, uncertainty prevails about the specifics of upcoming changes.Adaptability is now crucial.Agents need to remain vigilant and proactive – not only stay aligned with Colorado real estate trends – but also hone skills adapting to ever-shifting landscapes.The board envisions maintaining high standards. Still, industry professionals have urged members to stay informed and prepared for potential transitions or service model adjustments, ensuring the seamless continuation of their operations.In this light, aligning oneself with a trusted resource like 719 Lending becomes imperative. It offers tools and advice crucial for navigating complex changes in Colorado’s real estate market. Together, they can ensure resilience and growth.Future of REcoloradoThe recent sale of REcolorado to a private equity firm has raised many questions about the future.As shareholders and executives work through the finer details, members and stakeholders express a mix of optimism and concern. They are hopeful that the new ownership can inject fresh capital and resources to enhance technology and services. Simultaneously, there is a palpable worry about potential disruptions or strategic shifts.Change is inevitable and often brings opportunities for growth. REcolorado’s management team is committed to safeguarding the interests of its 25,000 members. They have already started consulting with legal experts to ensure that the transition is as smooth and beneficial as possible.In these evolving times, professionals across Colorado’s real estate sector must stay vigilant and adaptable. Partnering with a reliable ally such as 719 Lending is more important than ever. Their expertise and steadfast guidance can help realtors navigate through this transition, ensuring continued success and stability in their ventures.Explore Financing Options with 719 LendingWhen navigating the ever-evolving landscape of Colorado real estate, one paramount aspect remains—securing the right financing. This is where 719 Lending steps in, offering personalized solutions tailored to meet individual needs.719 Lending understands the complexities of the Colorado market. Their experienced team is well-versed in the nuances that can make or break a transaction.Not all financial institutions provide the same level of attention or customized plans. Partnering with 719 Lending ensures clients receive optimal guidance and support.With a range of financing options available, 719 Lending accommodates diverse needs. They work diligently to offer competitive rates and solutions that fit different budgetary constraints.Their commitment to excellence is evident in their comprehensive approach. From pre-approvals to closing, they assist with each step, ensuring clients are well-informed and confident in their financial decisions.Explore your financing options today with 719 Lending. Visit 719 Lending and discover how their expertise can power your real estate dreams. The post REcolorado Sale to Private Equity Firm: Colorado Realtor appeared first on 719 Lending.

Read MoreWhy Getting Pre-Approved for a Mortgage is Important

In the competitive real estate market, getting pre-approved for a mortgage is a crucial step that can significantly enhance your home buying journey. Here’s why obtaining pre-approval should be at the top of your to-do list before you start house hunting.5 Benefits to Getting Pre-Approved For a MortgageKnow Your BudgetOne of the primary benefits of mortgage pre-approval is that it gives you a clear understanding of how much you can afford. Lenders will assess your financial situation, including your income, debts, and credit score, to determine the maximum loan amount you qualify for. This helps you set a realistic budget and focus on homes within your price range.Stronger Negotiating PositionPre-approval strengthens your position as a buyer. Sellers and real estate agents view pre-approved buyers as serious and financially stable, making them more likely to consider your offer. In a competitive market, having a pre-approval letter can set you apart from other buyers who haven’t taken this step.Faster Closing ProcessSince pre-approval involves a thorough review of your financial information, the mortgage approval process can be faster once you find a home and make an offer. This can be particularly advantageous in a fast-moving market where delays can result in losing out on your desired property.Identifying Potential IssuesGoing through the pre-approval process allows you to identify and address any potential issues with your credit or finances early on. This proactive approach can save you time and stress later, ensuring a smoother path to securing your mortgage.Enhanced ConfidenceKnowing you are pre-approved provides peace of mind and confidence as you search for your new home. You can focus on finding the perfect property without worrying about whether you’ll qualify for financing. ConclusionGetting pre-approved for a mortgage is a smart move that can streamline your home buying process and provide numerous advantages. By knowing your budget, improving your negotiating position, and expediting the closing process, pre-approval sets you up for success in your home search. Make sure to get pre-approved before you start looking at homes to enjoy these benefits.The post Why Getting Pre-Approved for a Mortgage is Important appeared first on 719 Lending.

Read MoreThe True Benefits of Homeownership

Owning a home is a cornerstone of the American Dream and for good reason. Beyond the pride of having a place to call your own, homeownership offers a variety of financial and personal benefits. Here’s why buying a home can be one of the best investments you make.Building EquityWhen you own a home, you build equity over time as you pay down your mortgage. Unlike renting, where your monthly payments only benefit the landlord, each mortgage payment you make increases your ownership stake in the property. This equity can be leveraged in the future for loans or to finance major expenses.Tax AdvantagesHomeowners enjoy significant tax benefits. Mortgage interest and property taxes are often deductible, reducing your taxable income. These deductions can lead to substantial savings, especially in the early years of your mortgage when interest payments are higher.Stable Housing CostsOwning a home provides stability in your housing costs. While rent can increase annually, a fixed-rate mortgage ensures your principal and interest payments remain constant over the life of the loan. This predictability makes budgeting easier and protects you from rising rental prices.Personal Freedom and StabilityHomeownership offers personal freedom to customize and renovate your living space to suit your tastes and needs. Additionally, owning a home can provide a sense of stability and community, as you’re more likely to stay in one place for a longer period.Wealth BuildingOver the long term, real estate typically appreciates in value. By owning a home, you can benefit from this appreciation, which can significantly boost your wealth. This appreciation, combined with equity buildup, makes homeownership a powerful tool for financial growth.ConclusionThe benefits of homeownership extend far beyond having a roof over your head. From financial advantages to personal satisfaction, owning a home is a worthwhile investment that can provide long-term stability and growth. If you’re considering buying a home, now is the time to explore the opportunities and take the first step toward homeownership.The post The True Benefits of Homeownership appeared first on 719 Lending.

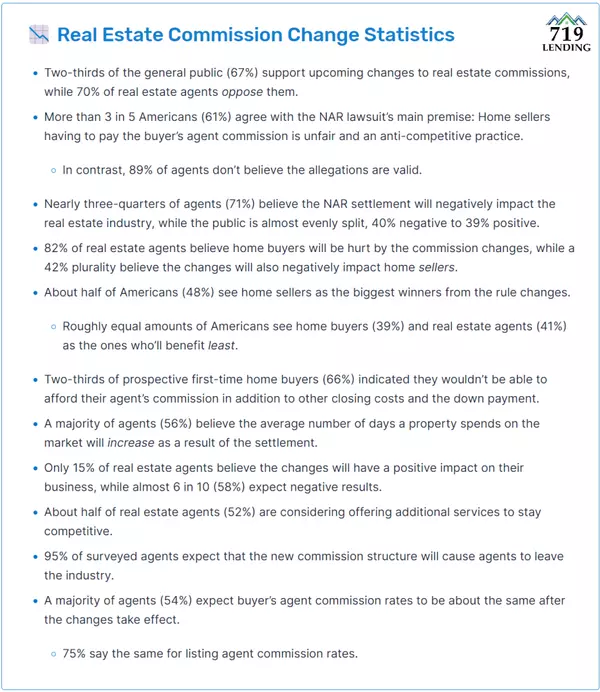

Read More70% of agents oppose NAR settlement: Clever Real Estate

Picture a bustling marketplace where different vendors throng, each vying for the attention of discerning customers. In this scenario, the National Association of Realtors (NAR) settlement feels like a sweeping reform, instigating varied reactions and expectations from the diverse crowd. I’m unable to directly add graphs from external URLs. However, I can guide you on how to describe the data visually in your blog post. Here’s how you can incorporate the data from the graphs into your content:https://listwithclever.com/research/real-estate-commission-changes-2024/?utm_source=press+release&utm_medium=pr&utm_campaign=agent_survey_2024SummaryA recent survey by Clever Real Estate reveals a significant divide between real estate agents and consumers regarding the National Association of Realtors’ (NAR) settlement. While 70% of agents oppose the settlement, 67% of consumers support it. This blog post delves into the survey findings and their implications for the Colorado Springs real estate market.Survey FindingsAccording to Clever Real Estate’s survey conducted in April 2024, there is a notable gap between the opinions of real estate professionals and the general public:Support for Settlement: 67% of consumers support the NAR settlement, while 70% of agents oppose it.Awareness: Only 36% of consumers are aware of the settlement, yet 70% of agents have received inquiries from clients about its impact.Primary Argument: 61% of consumers agree that the practice of home sellers covering the buyer’s agent commission is unfair, whereas 89% of agents disagree.Impact on BusinessThe survey highlights the anticipated impact of the settlement on the real estate business:Negative Repercussions: 71% of agents foresee negative repercussions, while only 40% of consumers share this sentiment.Business Impact: 58% of agents believe the changes will negatively affect their business, with only 15% expecting a positive impact.Consumer and Agent PerspectivesThe survey also sheds light on the differing perspectives between consumers and agents:Consumer Concerns: Consumers opposing the changes cite increased burden on homebuyers (47%), discouragement to first-time buyers (36%), and market uncertainty (29%).Agent Concerns: Agents believe the settlement will discourage first-time buyers (88%), hurt buyers (82%), and negatively impact sellers (42%).Benefits of the SettlementDespite the opposition, there are perceived benefits to the settlement:Consumer Benefits: 44% of consumers believe the changes will ease the financial burden on sellers, 41% think it will create a level playing field, and 32% say it will improve trust.Agent Adaptation: 52% of agents are considering additional service offerings to stay competitive. Future ImplicationsThe survey indicates that the NAR settlement will have significant implications for the future:Impact on Homebuyers and Sellers: 91% of Americans believe the settlement will affect future homebuyers and sellers, with lower commission rates (30%) and increased competition (26%) being the most commonly cited impacts.First-Time Buyers: 66% of first-time buyers say they cannot afford a buyer’s agent commission on top of other costs.ConclusionThe Clever Real Estate survey highlights a clear divide between agents and consumers regarding the NAR settlement. As the Colorado Springs real estate market navigates these changes, it’s crucial for both buyers and sellers to stay informed and consider the potential impacts on their transactions.For more information and expert advice on navigating the Colorado Springs real estate market, visit 719 Lending.Original post found here: https://listwithclever.com/research/real-estate-commission-changes-2024/?utm_source=press+release&utm_medium=pr&utm_campaign=agent_survey_2024The post 70% of agents oppose NAR settlement: Clever Real Estate appeared first on 719 Lending.

Read MoreHome Buying in 2024: 4 Items to Be Aware of

As we step into 2024, the real estate market continues to evolve, bringing new trends and challenges for homebuyers. Whether you’re a first-time buyer or looking to upgrade, understanding the current landscape is crucial for making informed decisions. Here’s what you need to know about home buying in 2024.Home Buying in 2024: 4 Items to Be Aware of1.) Market TrendsThe housing market in 2024 is characterized by moderate price growth and increasing inventory levels. This shift provides buyers with more options compared to previous years. However, demand remains high, particularly in suburban areas and smaller cities where remote work has boosted interest.2.) Interest Rates and FinancingMortgage interest rates have stabilized, offering a favorable environment for buyers. It’s important to shop around and compare rates from different lenders to secure the best deal. Additionally, consider getting pre-approved for a mortgage to streamline your home buying process and demonstrate your seriousness to sellers.3.) Technology in Home BuyingThe role of technology in real estate has expanded significantly. Virtual tours, online mortgage applications, and digital closing processes make buying a home more convenient than ever. Embrace these tools to save time and enhance your buying experience.4.) Preparing for the PurchaseBefore you start house hunting, ensure your finances are in order. Review your credit score, save for a down payment, and create a realistic budget. Engage with a knowledgeable real estate agent who can guide you through the complexities of the market and help you find your dream home. ConclusionHome buying in 2024 offers exciting opportunities with the right preparation and knowledge. Stay informed about market trends, leverage technology, and work with professionals to navigate the process smoothly. By doing so, you’ll be well-equipped to make a successful and satisfying home purchase this year.The post Home Buying in 2024: 4 Items to Be Aware of appeared first on 719 Lending.

Read MoreVA Issues Temporary Fix to Allow Buyer-Paid Broker Fees